PCE Inflation Eases, US GDP Growth Surpasses Expectations, Mortgage Demand Drops as Homebuyers Wait for Lower Rates: Portafolio Capital Markets Recap for Week Ending 7/26/2024

PCE Inflation Shows Signs of Easing

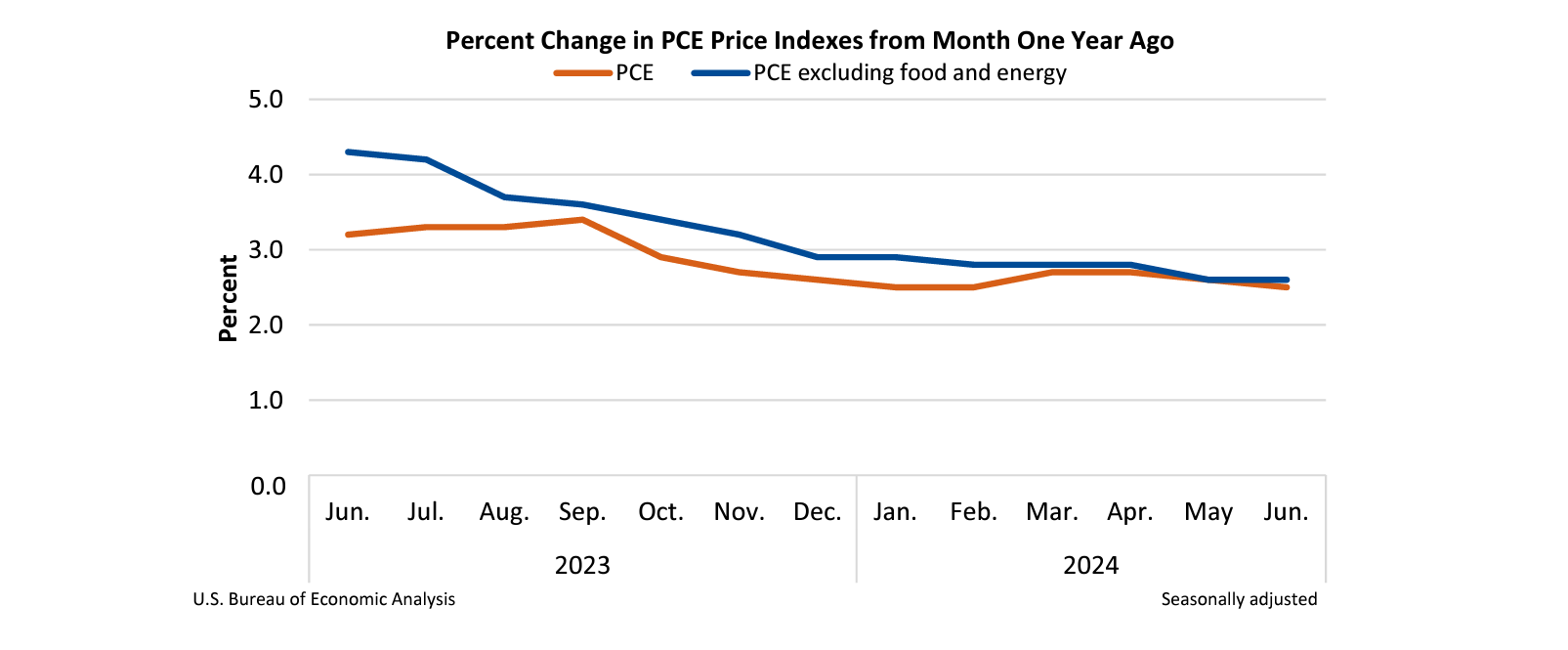

The Personal Consumption Expenditures (PCE) price index for June 2024 revealed a deceleration in inflation. Core PCE inflation, which excludes volatile food and energy prices, increased 2.6% year over year (.2% monthly increase). Overall, PCE prices (including food & energy prices) increased by 0.1% for the month, showing a year-over-year rise of 2.5%.

This rate of change is consistent with other economic indicators, including recent CPI data, suggesting easing price pressures across the U.S. economy. The cooling inflation data raises the likelihood that the Federal Reserve might lower interest rates as early as September, assuming continued favorable inflation trends. Market confidence is growing for two potential rate cuts before the end of the year, with the first possibly occurring in September and another by December.

The CME Group produces a tool FedWatch, tracking the probabilities of changes to the Fed rate, as implied by 30-Day Fed Funds futures prices. That tool is currently pricing in a drop in the Fed Funds rate by 25 basis points at 88% as of the writing of this article. That tool can be found here.

Federal Reserve officials have emphasized the need for a series of consistent inflation reports showing controlled price increases before making any rate cuts.

The full PCE report by the US Bureau of Economic Analysis can be found here.

-

US GDP Growth Surpasses Expectations in Q2 2024

The U.S. economy grew at an annualized rate of 2.8% in the second quarter of 2024, exceeding forecasts of 2.6%. This growth was primarily driven by robust consumer spending, which saw a significant uptick, and increased government expenditures. Additionally, a notable rise in inventories contributed to the GDP boost.

Consumer spending, a major component of GDP, remained strong despite ongoing inflationary pressures, reflecting resilient domestic demand. The Federal Reserve's efforts to curb inflation have started to show results, but inflation remains a critical factor influencing future economic policies.

The labor market remained tight, with the unemployment rate increasing steadily at 4.1%. However, a gradual increase in unemployment is anticipated over the next two years as economic growth moderates.

Economic analysts suggest that if the current trend of disinflation continues, the Federal Reserve might consider cutting interest rates by the summer (September 18th meeting), aiming to support sustained economic growth without stoking inflation further.

The full press release by the US Bureau of Economic Analysis can be found here.

Mortgage Demand Drops as Homebuyers Wait for Lower Rates

Mortgage interest rates eased slightly last week, with the average contract rate for 30-year fixed-rate mortgages dropping to 6.82% from 6.87%, according to the Mortgage Bankers Association (MBA). Despite this decrease, mortgage applications for home purchases fell by 4% compared to the previous week and are now 15% lower than the same week last year. The Market Composite Index, a measure of mortgage loan application volume, decreased 2.2% on a seasonally adjusted basis from one week earlier.

Refinance applications remained flat, increasing by just 0.3% for the week, though they are 38% higher than the same week last year. The refinance share of mortgage activity increased to 39.7% of total applications from 38.8% the previous week. Adjustable-rate mortgage (ARM) activity remained unchanged at 5.8% of total applications.

Other loan types saw varied changes: the average rate for 30-year fixed-rate jumbo loans increased slightly to 7.09%, while the rate for FHA-backed 30-year fixed-rate mortgages decreased to 6.71%. Additionally, the rate for 15-year fixed-rate mortgages dropped to 6.21%, and the rate for 5/1 ARMs decreased to 6.19%.

The full survey by the MBA (Mortgage Bankers Association) can be found here.

www.portafoliocapital.com/subscribe

Portafolio Capital Management is an independent wealth and capital management firm based in San Antonio, Texas. With over 12 years of combined investment and macro-economic analysis experience, our goal is to instill confidence in our investors through how we view markets and our investment approach. As a Registered Investment Advisor (RIA) and fiduciary, we are held to the highest standard when it comes to managing your money and are bound by law to act solely in your best interest.

Learn more about our strategy and management style by scheduling a 15-minute warm meeting at: https://calendly.com/portafoliocapital/15min.

All content is not to be received as financial advice and is for informational purposes only. Each individual should consult with their dedicated financial advisor, tax preparer, estate attorney, etc. before making any financial or investment decisions. Portafolio Capital does not recommend (nor does it make recommendations of) the buying or selling of any securities through any of our published content mediums. We expressly disclaim and do not assume any liability in connection with any inaccuracies in any of the information provided or in connection with information stated. While we do our best to vet thoroughly and provide you with information from reputable resources, not limited to: FRED, Yahoo Finance, CNBC, and company specific investor websites, unfortunately we cannot guarantee the accuracies of such and ask that you do your own due diligence when researching any finance, economics, and earnings information. Furthermore, we do not undertake an obligation to update or revise publicly any information as it changes. Please read our entire legal disclaimer page at portafoliocapital.com/disclosures-and-documents

Chief Investment Officer